Energy crisis shook the derivatives market

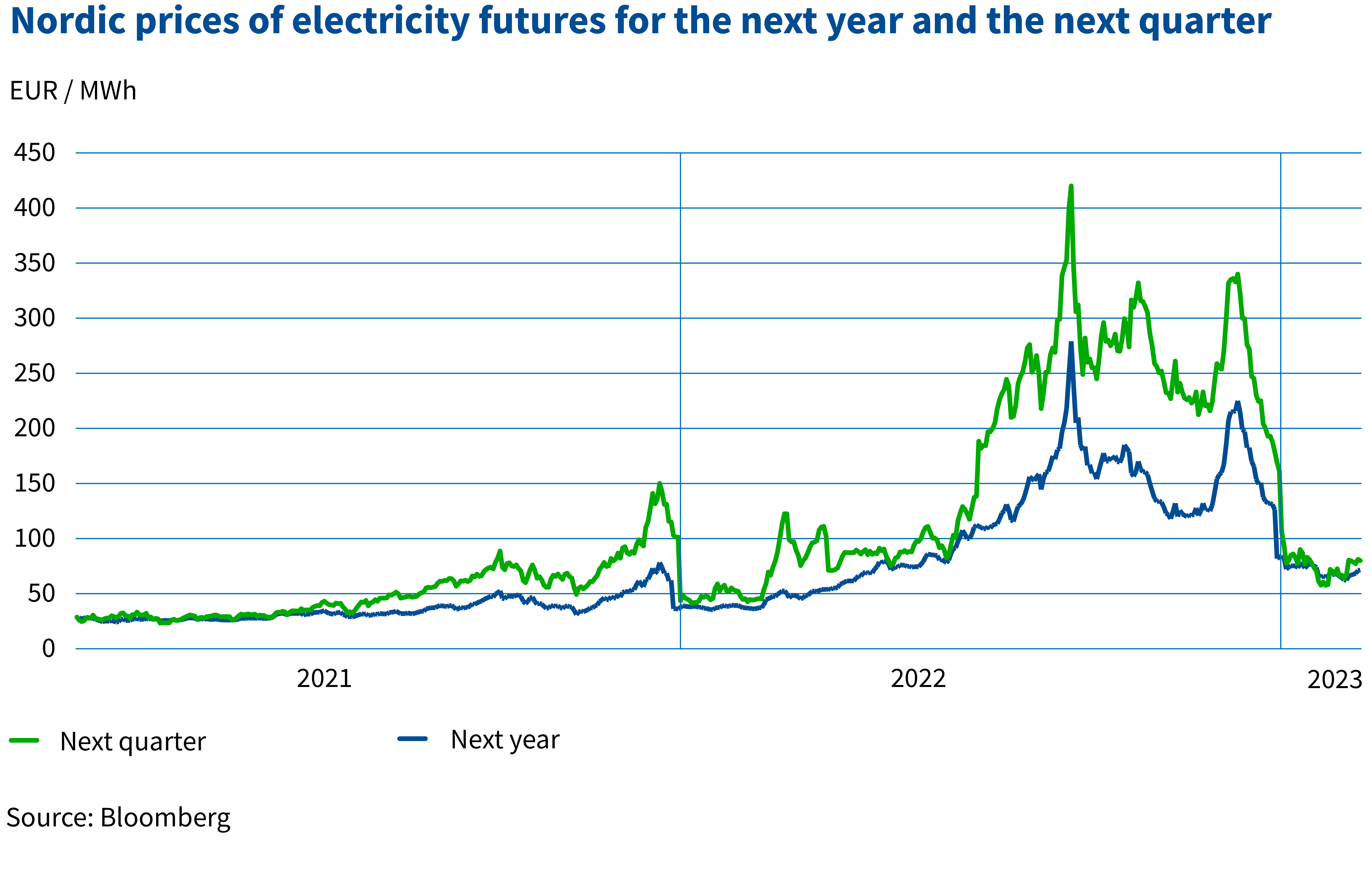

Energy prices in Europe rose steeply in 2022 as a result of the Russian invasion of Ukraine. In particular, the price of electricity in the Nordic countries shot up. One of the FIN-FSA’s duties is to supervise the electricity derivatives market in cooperation with the Energy Authority. The electricity derivatives markets have been accorded rather limited attention in previous years, reflecting stable market conditions. In autumn 2022, however, the steep rise of futures prices posed threats to the operability of the markets.

Collateral requirements in the electricity derivatives markets rose considerably

Nasdaq Commodities, an electricity derivatives exchange operating in Norway, is supervised by the Norwegian financial supervisory authority, while the clearing of exchange trades takes place at Nasdaq Clearing, a Swedish central counterparty, which is supervised by the Swedish financial supervisory authority.

In order for the central counterparty to ensure secure risk management, regulation requires that it collects collateral from both parties to a derivatives transaction, i.e. the buyer and seller of electricity derivatives. In the autumn, the extremely high prices prevailing on the electricity derivatives exchange and strong price fluctuations increased the collateral requirements at Nasdaq Clearing1, which reached exceptional highs for certain counterparties. This caused liquidity problems for some energy companies and increased the risks to the operation of the whole market. For example, the Finnish energy company Fortum announced in August that its collateral requirements on Nasdaq had grown significantly over a short period of time. Late August/early September was a rather critical time on the derivatives market.

In early autumn 2022, it was seen as a risk that a counterparty to Nasdaq Clearing could fail to meet its collateral requirements. If a clearing counterparty were to fail on its collateral requirements, the central counterparty would have to assume responsibility for its exposures to other parties and, for example, auction its open derivatives contracts. This could incur losses to the central counterparty and ultimately also endanger its stability. The central counterparty’s difficulties could, at the extreme, pose risks to the financial system on a more extensive scale.

In the autumn, it was feared that the crisis in the derivatives market could spread across the economy. As a relief measure and to soothe these concerns, the Swedish and Finnish governments announced support measures for energy companies in September.

Calmer remainder of the year in the derivatives market

After the government intervention, the situation in the Nordic electricity market calmed down towards the end of 2022.

During the remainder of the year, the EU made certain regulatory amendments to contain rapid price fluctuations in the electricity and gas derivatives markets and to relieve the collateral requirements for central counterparty clearing.

1 To be exact, collateral on Nasdaq Clearing consists of a so-called initial margins and payments calculated daily based on changes in the market value of derivatives.