FIN-FSA’s supervisory actions in 2023

The FIN-FSA’s supervision and operational development were guided by the operations strategy finalised at the end of 2022, emphasising proactivity and predictability, the utilisation of digitalisation in operations, leadership that supports expertise, and flexibility and adaptability. During the year, the FIN-FSA reacted to the changes in the operating environment described above in the chapter ‘State of financial markets’. These included the weakening of the economy and falling into a recession, rise of the interest rate level, elevated risks in the real estate sector, challenging investment asset valuations, deteriorating consumer and business confidence as well as growth in cyber risks brought about by the tightening of the geopolitical situation.

Macroprudential decisions strengthened the resilience of the financial system

In the early part of the year, the FIN-FSA strengthened the resilience of the banking sector by imposing on Finnish credit institutions a systemic risk buffer requirement of 1%, which will enter into force on 1 April 2024. In the second quarter, the FIN-FSA reciprocated the systemic risk buffer imposed by the Norwegian macroprudential authority for partial application to Finnish banks’ exposures in Norway. Following the entry into force of the buffer requirements, the combined amount of the macroprudential buffer requirements on the Finnish banking sector rises to an overall level deemed adequate by the FIN-FSA.

In December of the review year, the FIN-FSA restored the housing loan cap, or the maximum loan-to-collateral (LTC) ratio, for non-first home buyers to its baseline level of 90%. The decision was justified by the reduction of vulnerabilities in the financial system due to the realised and anticipated decline in household indebtedness. In addition, the recommendation on the debt-servicing burden that entered into force at the beginning of 2023 helps contain risks associated with excessive indebtedness. The maximum LTC ratio was lowered by 5 percentage points in summer 2021 to contain risks related to the accumulation of household debt.

The recommendation issued by the FIN-FSA in June 2022 on the maximum debt-servicing burden for housing loan applicants entered into force in early 2023. A preliminary assessment of compliance with the recommendation was carried out in late 2023. A more comprehensive assessment will be conducted in early 2024.

Banking supervision reacts to changes in the operating environment

The indebtedness of Finnish households continued its decline, which started in 2022, and the amount of debt also began to trend downwards in 2023, but household indebtedness resulting from both housing loans and consumer credit remains at a high level. The supervision of certain consumer lenders and credit intermediaries was transferred from the Regional State Administrative Agency for Southern Finland to the FIN-FSA as of 1 July 2023.

The FIN-FSA assessed its new supervised entities’ fulfilment of the preconditions for registration, compliance with code of conduct and obligations under the AML Act, and management of default risk. This work will continue in 2024 and will lay the foundation for targeting risk-based supervision at this group of supervised entities.

Reflecting the changes in the operating environment, topics emphasised in banking supervision comprised the management of credit and liquidity risk, compliance with new interest rate risk regulation and corporate governance. Inspections targeted credit risk, liquidity risk, corporate governance and internal models used in capital adequacy calculation.

High inflation, increased energy costs and the rapid rise in loan interest rates weakened companies’ and households’ purchasing power and increased borrowers’ debt-servicing costs. The FIN-FSA targeted its supervision particularly at banks’ credit risks and analysed the effects of inflation and higher interest rates on them.

As a result of the market turbulence triggered in spring 2023 by difficulties among a few medium-sized US banks, banking supervision focused on the availability and price of liquidity and funding. The FIN-FSA assessed banks’ balance sheet items, paying particular attention to the valuation of items comparable to those that caused problems for US banks. Problematic balance sheet items consist of those that are not measured at market value on an ongoing basis.

Bank reviews focused on risk management

Banking Supervision conducted ten supervisory reviews (SREP) during the review year. The SREP is a process for assessing banks’ various risk factors, which is carried out every 1–3 years depending on the bank’s risk position and significance. In addition, thematic reviews and investigations were carried out at banks under direct FIN-FSA supervision or ECB supervision. Direct ECB supervision covers the most significant banks in Finland, i.e. Nordea, OP Financial Group, Municipality Finance and Danske Bank’s Finnish branch. Other banks in Finland are under direct FIN-FSA supervision.1

The FIN-FSA conducted a review of the present state of climate and environmental risks and related development plans in banks under its direct supervision as well as information published by the banks on these risks. This thematic review built on the ECB’s supervisory expectations for climate and environmental risk management, as applicable. Banks had not yet incorporated the impacts of climate and environmental risks in their risk management comprehensively in terms of different risk categories, but some progress could be identified.

The FIN-FSA assessed the implementation of regulation on the revised definition of default by banks under its direct supervision that apply the standardised approach to capital adequacy calculation. Differences were identified across the banks in their compliance with the definition of default. The most significant shortcomings were identified in the classification of non-performing forborne exposures as exposures in default, the definition of past due receivables and the calculation of the impaired value of an exposure in the context of restructuring. The FIN-FSA urged the banks to remediate the shortcomings, and it will follow up on the implementation as part of regular supervisory reviews.

In 2019, the FIN-FSA had assessed risk reporting provided to credit institutions’ boards of directors and, in the review year, it assessed the actions taken by the credit institutions based on the 2019 recommendations. In this thematic review, covering entities under direct FIN-FSA supervision, development of risk reporting was found to have taken place in all supervised entities reviewed. However, there was major variation across different risk areas and supervised entities. The content of risk reports had become more versatile, and clear improvement had taken place, for example through the addition of different risk areas and components, visual illustrations and forward-looking scenarios, allowing the members of the board of directors to formulate a view of the essence of the risk and the significance of the components for the resulting risk exposure. The credit institutions had also added textual analysis to the reports.

The European Banking Authority (EBA), the European Central Bank (ECB) and the FIN-FSA conducted stress tests of Finnish banks, and the results will be utilised by the authorities in their supervision. Among other things, they help ensure that each supervised entity has adequate own funds to cover material risks. The stress tests covered the years 2023–2025 and included both a baseline scenario and one characterised by weaker development.

The FIN-FSA conducted a corresponding stress test for banks under its direct supervision in Finland. Based on the results, the capital adequacy of smaller Finnish banks will remain on average good also in the weak scenario. The average capital adequacy (CET1) declined in the weak scenario by 3.8 percentage points to 11.4%. However, there were major differences between the banks.

Based on the results of the stress test, the FIN-FSA imposed for the first time a Pillar 2 Guidance (P2G), an indicative additional capital buffer recommendation, for banks under its direct supervision. In addition, the FIN-FSA imposed a discretionary buffer on the leverage ratio for the first time.

The supervision of the largest banks directly supervised by the ECB was based on the priorities of the ECB’s banking supervision. The ECB amplified its activities to amend protracted shortcomings demonstrated by European banks under its supervision and imposed actions to address them. It urged banks to remediate qualitative deficiencies in their internal governance, credit risk management and capital planning. These qualitative measures are a key part of the banking supervision toolbox. Banks must pay particular attention to internal governance and control because three out of four European banks under ECB supervision were urged to remediate related deficiencies.

In December 2023, the ECB slightly refocused its supervisory priorities for the next three years, which steer the supervision of all banks within the scope of common European banking supervision. The ECB asked banks to strengthen their resilience to macro-financial and geopolitical shocks (Priority 1) by remediating shortcomings in asset and liability management and the management of credit and counterparty credit risk. Banks were also requested to accelerate the effective remediation of shortcomings in governance and the management of climate and environmental risks (Priority 2). In addition, they were requested to make further progress in their digital transformation and building robust operational resilience frameworks (Priority 3).

Changes in the operating environment highlighted in the supervision of cyber and ICT risks

The FIN-FSA has monitored cyber security and the operability of payment systems on an enhanced basis due to Russia’s continued war of aggression and damage inflicted on critical infrastructure.2 Information concerning payment traffic and cyber incidents have been transmitted to other authorities in accordance with mutually established practices. No significant cyber incidents have been detected in the Finnish financial sector.

The FIN-FSA has, together with the Ministry of Finance, the Financial Stability Authority and the Bank of Finland, created a fallback system to secure the continuity of daily payments in the event that normal payment systems are unavailable amid severe civil disturbances or emergency conditions. If a bank were to suffer from protracted operative disruptions, its customers’ account and card services could be provided by the backup account system. The framework also entails, among other things, guaranteeing interbank payment traffic.

The EU Regulation on digital operational resilience for the financial sector (Digital Operational Resiliency Act – DORA) entered into force on 17 January 2023 and will apply as of 17 January 2025. European Supervisory Authorities (ESAs) have working groups in place to prepare lower-level regulation (Regulatory Technical Standards) to complement the Regulation, expected to be finalised in June 2024. The FIN-FSA has launched preparations for incorporating DORA into regulation and supervision.

In the spring of the review year, the FIN-FSA completed two inspections of ICT and information security risks and two thematic reviews (mapping of supervised entities’ ICT outsourcing chains and payment system abuse and the compensation process).

In autumn 2023, the FIN-FSA launched an inspection of ICT and information security risks directed at one banking group and a thematic review of a wider target group concerning the security of online banking, mobile banking and online payments.

In the insurance sector, supervision focused on customer protection and solvency

In insurance supervision, the themes of pension insurance, non-life and life insurance as well as prudential supervision were highlighted extensively during the review year. This was in line with both the FIN-FSA’s own supervisory focus areas and the Union-wide strategic priorities established by the European Insurance and Occupational Pensions Authority (EIOPA)

The themes in the supervision of conduct of business included insurance distribution, verbal claims decisions, professional competence of agents and the value of investment-linked policies for customers. The themes for non-life and life insurance groups focused on questions concerning good governance and risk management, such as the quality of own risk and solvency assessments and the management of interest rate risk and the impacts of inflation.

The themes in the supervision of pension insurance included employee pension companies’ outsourcing practices and information to be provided by supplementary pension institutions to the insured. The themes covered in the supervision of investment activities of pension, non-life and life insurance providers, included, for example, liquidity risk, while the supervision of unemployment funds looked into the funds’ investment plans.

As regards the supervision of conduct of business, customer protection has taken a prominent role in the European supervisory culture. The FIN-FSA prioritises statutory insurance classes in its supervision, but it also supervised, based on, among other things, customer enquiries, reactively other insurance classes, related product management and added value of the products for policyholders. The supervisor paid particular attention to the registration of insurance intermediaries and fulfilment of the registration requirements.

The FIN-FSA participated in EIOPA’s work the same way as in previous year, particularly in matters that are crucial from the perspective of the Finnish markets. Topics addressed on this forum during the year included sustainable development themes, such as market risks stemming from climate change, insurance technical risks stemming from natural catastrophes in the solvency requirement as well as digitalisation and cyber risks.

Sharing and utilisation of information highlighted in inspections and reviews

In insurance supervision, the efficiency and effectiveness of proactive and predictable supervision was improved by putting a particular emphasis on thematic reviews, more extensive analyses and communication of the results to the supervised entities. The objective was to maximise the visibility and effectiveness of the expectations posed by insurance supervision to supervised entities. In insurance supervision, nine thematic reviews were completed, and one was still in preparation at the turn of the year.

Insurance Supervision arranged events for pension foundations and funds, employee pension insurance companies and special supervised entities, insurance companies contact persons, unemployment funds as well as non-life and life insurance companies.

The FIN-FSA launched a project together with the Bank of Finland to analyse macroprudential risks in the pension and insurance sector. The first analytical report on the pension sector was completed in the first year-half.

Insurance Supervision strengthened its data-based supervision by rolling out the first part of software capable of analysing and stressing non-life and life insurance companies’ solvency and insurance liabilities. In addition, steps were taken in the supervision of conduct of business to promote the utilisation of Solvency II data.

In capital markets supervision, the focus was on market confidence and sustainability disclosures

In capital markets supervision, market confidence and compliance with the sustainability-related disclosure obligations promoted by the European Securities and Markets Authority (ESMA) were highlighted during the review year.

In its Markets newsletter, the FIN-FSA drew attention to what kind of transactions may be considered wash trades and thereby meet the criteria of market manipulation. Market participants must be able to trust that information available from the markets and transactions executed there are real and genuine.

The FIN-FSA presented good practices that can be applied by issuers in order to ensure that its interaction with analysts is in compliance with regulation. Interaction between listed companies and analysts may arouse suspicions of the disclosure of inside information, which may be likely to undermine confidence in the financial markets.

The FIN-FSA supervises financial statements prepared under the IFRS standards. Supervisory themes largely revolved around the macroeconomic environment, economic impacts of Russia’s war of aggression and climate issues. In addition, as regards real estate investment companies, there was a review of key topics related to the notes to financial statements, including the valuation of investment properties and notes related to financial liabilities.

During the review year, the FIN-FSA reviewed the organisation and quality of the compliance function in investment firms, management companies and AIFMs, and identified significant shortcomings in this area. In addition, the FIN-FSA carried out stress tests of real estate funds, also detecting significant shortcomings. Some of these firms failed to pay adequate attention in the stress test scenarios to market risks related to real estate in exceptional market conditions. Some of the firms also had shortcomings in the reporting of the results of stress tests to the board of directors.

In June 2023, the FIN-FSA prohibited the unauthorised provision of investment service by an entity that had applied for authorisation.

The FIN-FSA conducted a survey on sustainability reporting with audit committees of financial and non-financial listed companies. Based on the results, the FIN-FSA deemed that the companies represented very different stages in the adoption of sustainability reporting and that the schedule posed a challenge for many. In addition, there were challenges related to the collection of high-quality data, finalising the requisite systems in time and the scarcity of resources and expertise in the markets. Audit committees were aware of the new extensive regulatory framework related to sustainability reporting, but some respondents demonstrated a shallow knowledge.

During the review year, minimum level models were established for the supervision of sustainability reporting and supervision of the Sustainable Finance Disclosure Regulation. The models promote uniform supervisory practices in different areas of supervision. The European Commission supports national supervisors in the development of modern tools of supervision for sustainable finance, and the related development of an IT tool proceeded in line with the Commission’s project. Furthermore, towards the end of the year, the FIN-FSA participated in launching an ESMA project to tackle greenwashing.

An EU regulation establishing a European Single Access Point (ESAP) was adopted at the end of the review year. The FIN-FSA will function as one of the data collectors in Finland, and transmitting an extensive volume of data as required by regulation to the single access point will require significant IT systems changes within the FIN-FSA. The assessment and preliminary review of the changes was launched during the review year.

In addition, the FIN-FSA began preparation for new authorisations and supervision required by the EU’s Markets in Crypto-Assets Regulation, which becomes applicable in 2024.

Anti-money laundering supervision also to cover sanctions compliance

The FIN-FSA supervision strategy for anti-money laundering (AML) was adopted at the beginning of the review year. It highlights a risk-based approach and effectiveness, and also covers the prevention of terrorist financing and the supervision of sanctions compliance. AML supervision concerns all entities supervised by the FIN-FSA and is based on long-term risk assessment.

The FIN-FSA’s preventive role, i.e. communication and guidance, and the targeting of supervision on the basis of risks are at the core of the supervision strategy. In recent years, the market has seen the entry of many new kinds of small and international players that may not necessarily be aware of the content of legislation or the supervisor’s expectations. The objective of supervision is always that supervised entities know how to act correctly and there is no need to impose sanctions. Supervision covers the entire life cycle of the operators, starting from the application for registration or authorisation. Operators with the most significant overall risk are subject to regular supervision and yearly inspections or thematic reviews.

The reforms of the Anti-Money Laundering Act entered into force in spring 2023, and the FIN-FSA issued its regulations and guidelines on anti-money laundering in late June 2023. At the same time, responsibility for the supervision of sanctions compliance was vested with the FIN-FSA. The related regulations and guidelines were issued in December 2023 and they enter into force in March 2024.

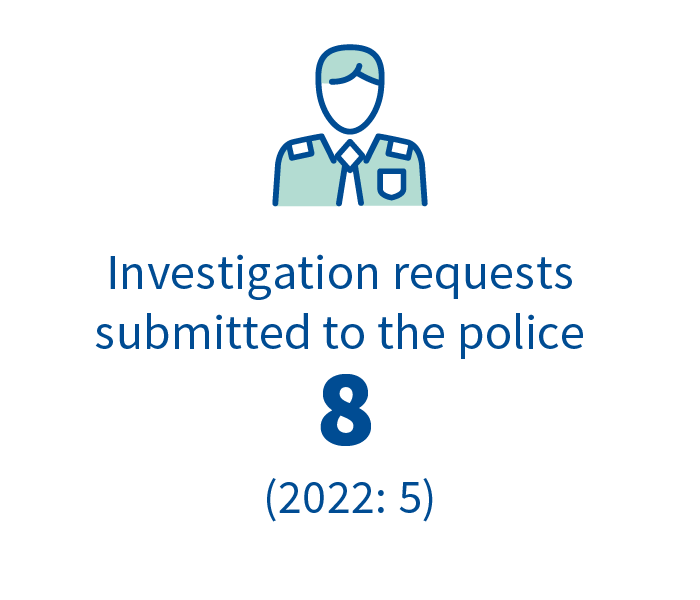

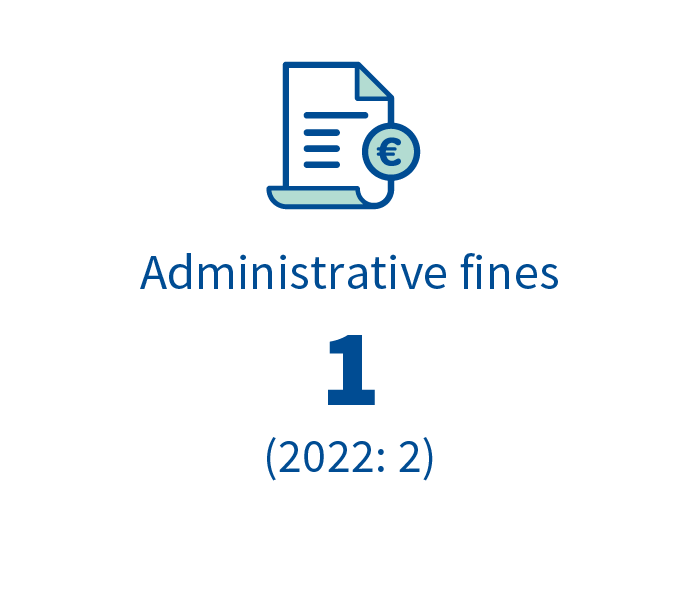

The FIN-FSA conducted inspections concerning money-laundering according to plan. In 2023, three inspections were completed, and four new inspections were launched. Inspections were targeted in line with the AML supervision strategy at new areas of activity, such as payment service providers. In addition, the supervision of hawala-type money transmitters remains a focus area. During the review year, the FIN-FSA cancelled the registration of one obliged entity on the grounds of shortcomings in anti-money laundering.

During the year, the supervision of certain consumer lenders and credit intermediaries was also transferred to the FIN-FSA, and related AML analysis will continue into 2024.

The supervision of anti-money laundering is a very international activity. The FIN-FSA is particularly committed to the activities of the FATF (Financial Action Task Force), which provides input to the upcoming country assessment round. Towards the end of the year, political accord was reached regarding the establishment of a European Anti-Money Laundering Authority (AMLA).

1 Described in more detail in the sub-chapter ‘Cooperation with the European Central Bank and the European Supervisory Authorities.

2 Damage to the gas pipeline and telecommunications connection between Finland and Estonia detected on 8 October 2023.