State of financial markets

Although the Finnish economy avoided the anticipated recession in early 2023, economic development was generally weak towards the end of the year.1 Sluggish cyclical development weakened the operating environment of the Finnish financial sector and kept risks at an elevated level. Risks increased particularly in the real estate markets. The strong solvency of the financial sector, however, provided protection against the risks brought by a deteriorating operating environment.

The weak economic development in 2023 was driven by the persistently high level of interest rates, weak consumer and business confidence and contraction of exports. Feeble cyclical development and lacklustre demand, in combination with rising management, repair, construction and financing costs, are taking a particularly heavy toll on the real estate and construction sector. Declining real estate prices, subdued sales volumes and market uncertainty are also elevating the credit, investment and liquidity risks in the financial sector and challenging current asset valuations.

The Bank of Finland is forecasting continued sluggish economic development in Finland in 2024, although the deceleration of inflation and rising wage level are lending support to private consumption.2 Expectations of a decline in interest rates and data on strong US economic development in early 2024 have supported market sentiment, but financial market sentiment is prone to rapid shifts when faced with negative news or shocks. The risks to economic forecasts include, for example, geopolitical risks, protracted high inflation and a weakening of the employment situation.

Uncertainty will keep the risks of the Finnish financial sector at a high level in the short term. In the long term, financial sector operators are also challenged by persistent change trends, such as the impacts of climate change (ESG risks), demographic change, digitalisation, new technologies, the development of new types of products and operating models (e.g. cloud services and artificial intelligence) as well as ICT and cyber risks.

The Finnish financial sector as a whole has remained well capitalised despite the weakening of the operating environment. Strong capital adequacy provides protection against risks brought about by a deteriorating operating environment. Non-performing exposures of the banking sector relative to the credit stock have remained at a low level, although there have been signs of an increase in credit risks. Finnish banks’ liquidity position has remained stable. The situation of the insurance sector has also stayed solid in spite of the development of the investment markets.

Capital adequacy and profitability of the banking sector improved due to good profit performance

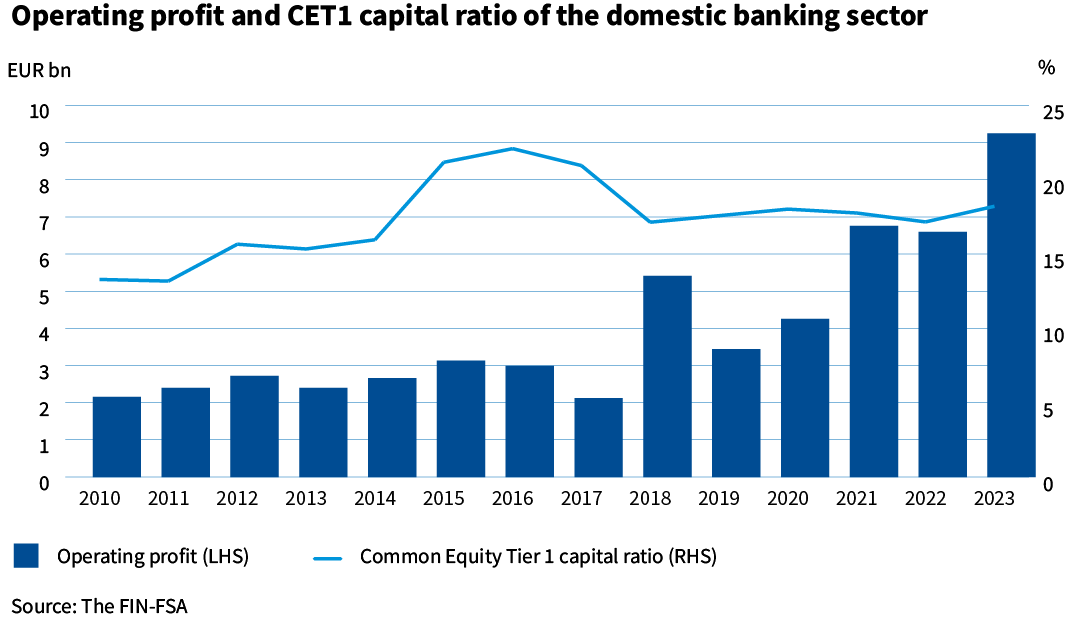

The capital ratios of the banking sector improved during the review year. This was primarily due to growth of CET1 capital as a result of solid profit performance. The surplus of own funds of the banking sector relative to the total capital adequacy requirement improved despite the tightening macroprudential requirements, and banks continued to have ample capital relative to the requirements. Their capital ratios remained above European averages in the review year.

The operating profit of the banking sector grew significantly during the review year on the back of strong growth in net interest income. Net interest income was also the most important income item for Finnish banks.

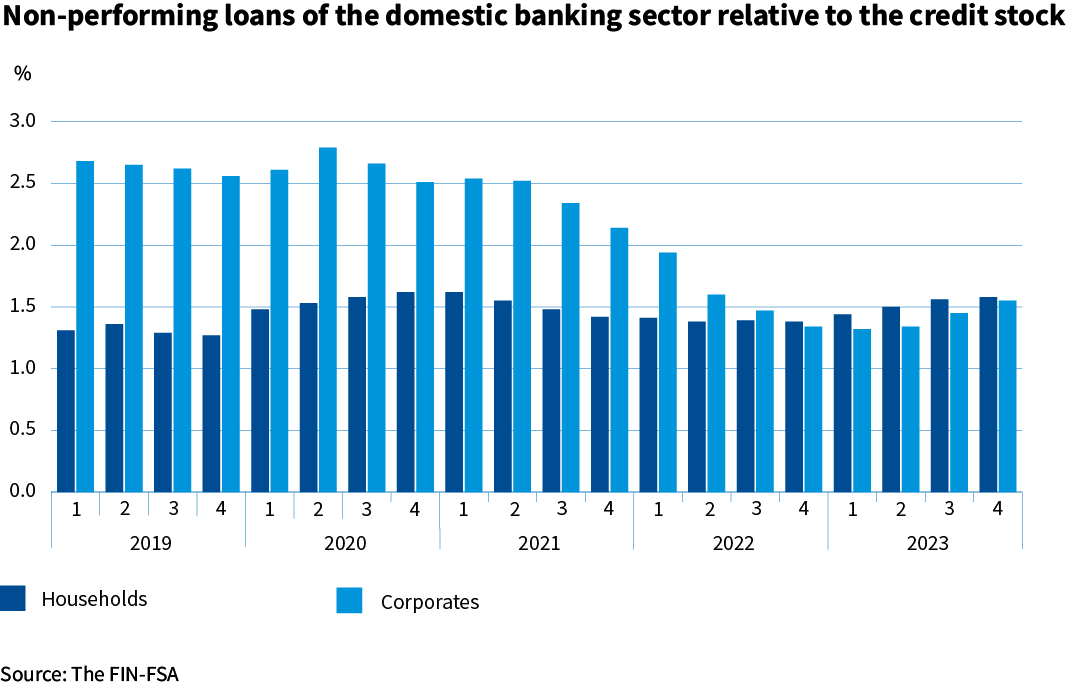

Non-performing loans in the banking sector remained at a low level and among the lowest in Europe, although there was marginal growth both in non-performing corporate and household loans. During the review year, there was increased migration of credit into higher credit risk impairment categories, signalling an increase in credit risks. Loans classified as involving elevated credit risk increased, particularly among corporate loans granted to the real estate and construction sector.

The liquidity position of the banking sector remained strong, and liquidity improved during the review year. However, the Finnish banking sector’s above-average dependency on market-based funding exposes banks to potential market disruptions, and the general rise of the interest rate level has also increased domestic banks’ market funding costs.

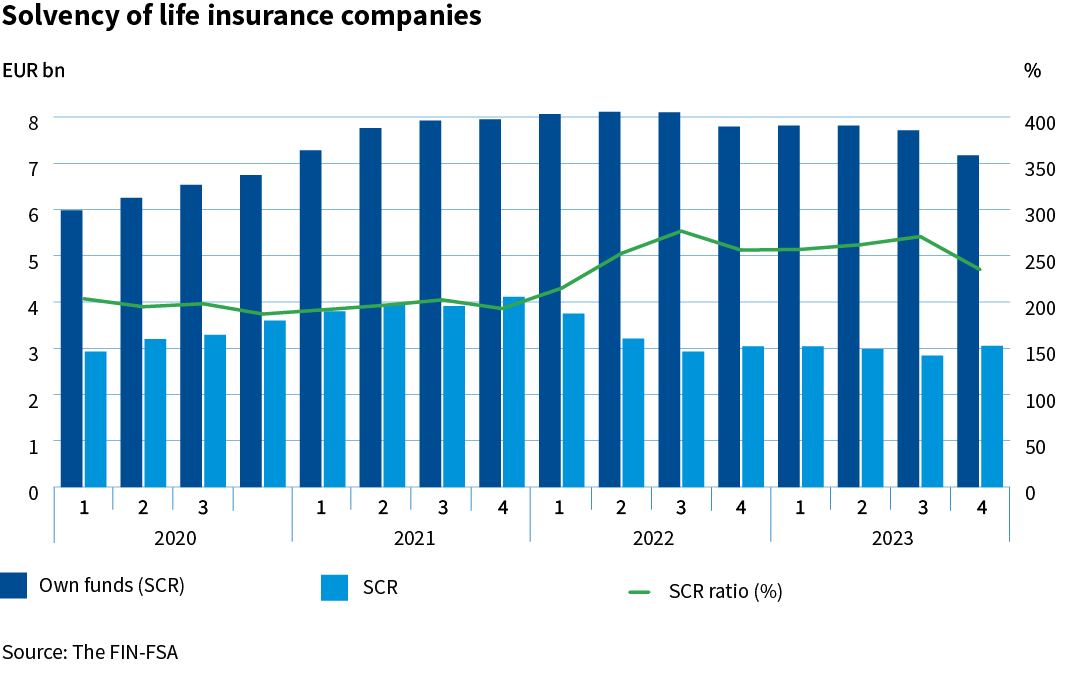

Life insurance companies’ solvency weakened towards the end of the year

The solvency ratio of the life insurance sector declined from a year ago. Own funds diminished considerably in the last quarter, as the rapid fall in interest rates increased the amount of insurance liabilities. At the same time, the Solvency Capital Requirement (SCR) grew only slightly from a year earlier.

Life insurance companies’ investment returns amounted to a solid level of 6.2% in 2023. Most of the returns were made in the last quarter. Both fixed-income and equity investments generated clearly positive returns, but real estate investment returns were negative, at -4.9%.

Insurance premium income rose slightly from the previous year. The growth of the premium income stemmed from corporate customers’ capital redemption policies. Claims paid declined slightly from the previous year.

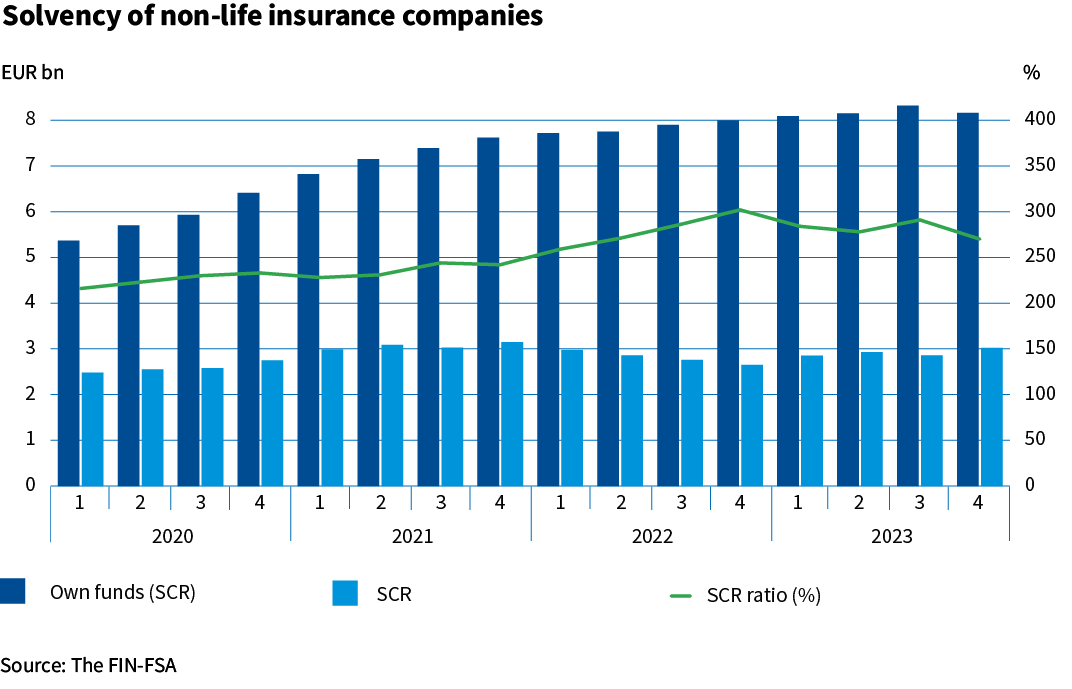

Non-life insurance companies’ solvency remained solid, although it was weakened by the growth in market risks

The solvency ratio of the non-life insurance sector weakened at the end of the year in comparison with the end of 2022, which marked the highest level during the Solvency II period (since 1 January 2016). Solvency was reduced by the growth of the capital requirement due to higher equity prices and the growth of the market value of insurance liabilities due to the decline in the level of interest rates compared to the end of 2022. Nevertheless, solvency remained solid as investment returns bolstered own funds and the value of insurance liabilities remained lower than its average level despite the decline in interest rates.

The returns on fixed-income and equity investments were positive, but real estate investments provided a negative return due to weak market conditions. The best returns were generated in equity investments.

The profitability of the insurance business excluding calculation base changes weakened from 2022 but remained positive. Profitability was reduced by higher claims and operating expenses. These were increased, among other things, by higher medical insurance claims, reinsurance prices, inflation, and growth in ICT expenditure.

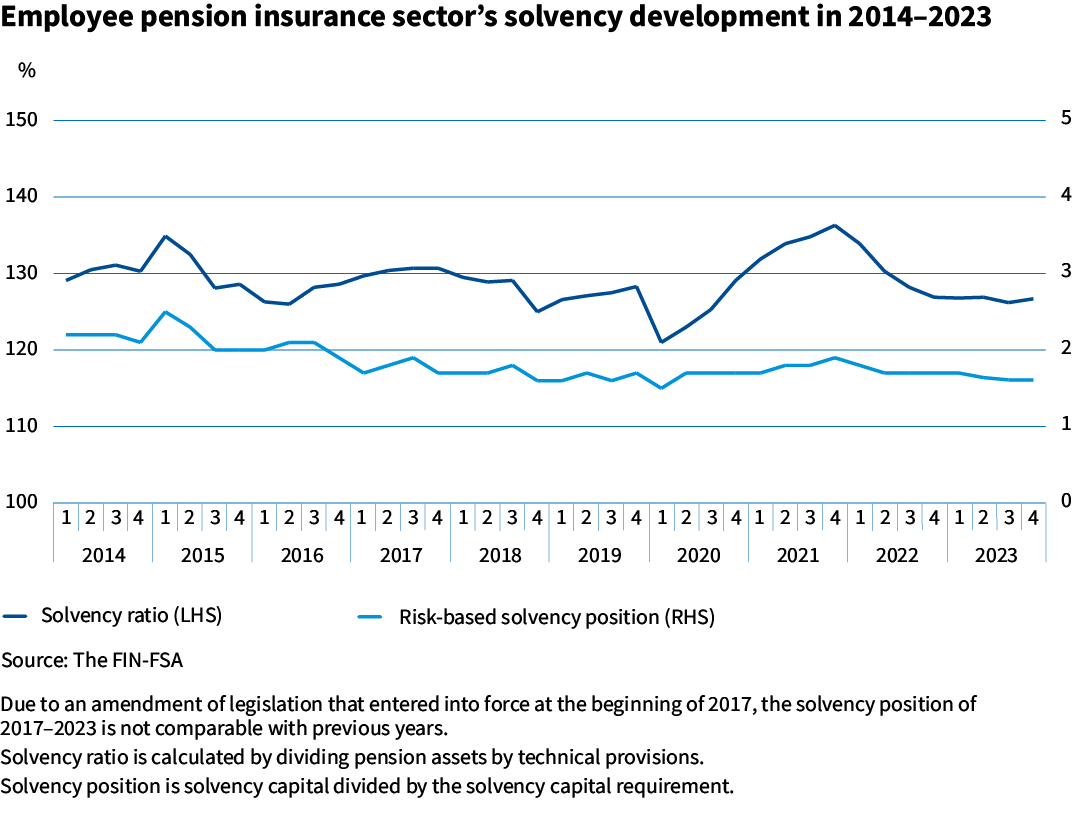

Solvency of the employee pension sector was almost unchanged and remained at a solid level

The solvency capital of the employee pension sector grew during the review year due to strong investment returns. The solvency ratio, which indicates the ratio of solvency capital and insurance liabilities, remained almost unchanged. The solvency position, which refers to solvency capital divided by the solvency limit, weakened slightly as the solvency limit rose faster than the solvency capital due to increased risk-taking. The growth of the solvency limit is mainly explained by higher investment assets and the higher equity allocation.

The positive valuation change of the investment assets was mainly due to the solid return on equity and fixed-income investments. The return on real estate investments fell into negative territory due to a negative change in the value of real estate. Employee pension institutions’ resilience to equity shocks remained at a reasonable level. Employee pension institutions continue to be able to withstand negative changes in the values of illiquid real estate and private equity funds.

FIN-FSA-related topics most visible in the media

1. Household indebtedness

2. Financial stability

3. Prospects of the real estate and housing markets

4. Money laundering and sanctions

5. Mergers and acquisitions

1 Further information on the state of the Finnish economy in 2023 is available in the Bank of Finland’s economic review and forecast (in Finnish) https://www.eurojatalous.fi/fi/2024/artikkelit/suomen-talous-pakkasella/.

2 See https://www.suomenpankki.fi/en/media-and-publications/releases/2023/finlands-economy-is-in-recession-and-the-recovery-will-be-slow/.