Supervision responsive to changing operating environment

The FIN-FSA re-prioritised its tasks under the action plan 2020 as a result of the exceptional situation caused by the coronavirus pandemic. Tasks were divided into three categories: critical supervision-related tasks, discretionary supervision related tasks, which may be postponed if necessary, and tasks to be re-planned or moved to 2021.

- Critical supervision-related tasks

- Adequate securing of ongoing supervision at the requisite level (including application issues), supervisory measures due to the coronavirus-induced situation and other critical grounds, analysis of supervised entities’ significant risks, sanctions on severe misconduct and violations, and development of own operations according to the requirements posed by the exceptional situation.

- Discretionary supervision-related tasks, which may be postponed if necessary

- Certain strategic development projects, such as supervision of the digitalising financial sector, integration of climate change into supervision and determination of the minimum level of supervision, participation in ECB1 and ESA working groups, surveys and other inquiries as well as non-urgent objectives related to the development of activities.

- Tasks to be re-planned or moved to 2021

- Plans concerning inspections, thematic reviews and the supervisory review and evaluation process were updated in September. A consultant study on the FIN-FSA's efficiency and resource allocation, the implementation of the EBA’s2 stress tests for 2020 and of the national LSI3 stress tests as well as updating of the fee schedule were postponed to 2021. Tasks postponed during the coronavirus pandemic will be reconsidered in terms of resourcing and priorities where necessary before implementation.

The FIN-FSA put a significant proportion of its inspection activities on hold in the spring. This enabled the supervised entities and the FIN-FSA to focus on the analysis of changes and risks caused by the pandemic in the financial sector and on related actions. Some inspections continued on a teleworking basis, however. In the autumn, inspections again took place almost normally, but they were all conducted virtually.

The FIN-FSA’s strategy for 2020–2022 was renewed at the end of 2019. The strategy highlights three areas significant from a supervision point of view: climate change, digitalisation and anti-money laundering. The strategy now also places a stronger emphasis than previously on risk-based supervision.

In 2021, the FIN-FSA will continue to assess how the deterioration of the economic situation due to the coronavirus pandemic is affecting supervised entities. The supervisor also raises its preparedness for crisis by developing further its operating models for crisis resolution as well as related internal guidance and cooperation models with other authorities. Ensuring the operating capabilities provided in the law is part of crisis preparedness. If the situation deteriorates, resources will be allocated to the management of the acute crisis and other operations will give way to crisis activities.

Banking sector

The FIN-FSA supervised on an enhanced basis the impacts of the economic crisis caused by the coronavirus pandemic on banks’ capital adequacy, liquidity and operational risk position, and distributed this information to other authorities. The supervisor analysed the development of corporate finance by banks in enhanced cooperation with the Bank of Finland and the Ministry of Finance. The FIN-FSA monitors developments in banks’ capital adequacy, liquidity and operational risks on an enhanced basis and as required by the exceptional situation.

Joint Supervisory Teams (JST4) of the ECB and the respective national supervisors enhanced the monitoring of the risk position of Significant Institutions (SI5) in accordance with the ECB’s guidance. The FIN-FSA's banking supervision analysed the risk position of LSI banks under its direct supervision in so-called corona projects, as a result of which the banks with the highest risks to capital adequacy or liquidity were identified. Banks’ liquidity situation has been monitored on an enhanced basis throughout the coronavirus pandemic. The supervisor and the Bank of Finland have assessed the development of banks’ credit losses in co-operation.

The FIN-FSA conducted supervisor reviews of significant institutions and the most significant foreign branches in accordance with the schedule established by the ECB and the home country supervisor. The FIN-FSA also launched two supervisory reviews of LSIs under its direct supervision, which were completed in early 2021. In the summer, some of the assessments of banks’ internal models were competed, and more extensive inspection activities resumed in the autumn.

The ECB and EBA took special measures to maintain banks’ lending capacity in the exceptional situation, particularly at the early stages of the coronavirus pandemic. The ECB and EBA adopted concessions allowed by regulation and provided recommendations to supervised entities ensuring that these concessions are allocated to supporting the real economy. The FIN-FSA participated in the preparations and applied corresponding principles in its supervision.

There is a significant ongoing domestic regulation initiative called the banking package, and the FIN-FSA participated in its preparation in a working group led by the Ministry of Finance.

In December, the FIN-FSA published a report on the pricing and availability of basic banking services. The study included a survey on the impacts of the coronavirus pandemic on the supply of basic banking services and on customer behaviour. It also mapped improvements made by banks in their digital services to improve accessibility and usability.

In accordance with the government programme, the supervision of providers of instant credit will be centralised to the FIN-FSA. The exact timing of the change is not yet confirmed. The FIN-FSA is making preparations regarding its expertise and resources to be able to roll out the change at the beginning of 2022. The FIN-FSA has also cooperated with the Ministry of Finance to ensure that legislation would provide instruments as effective as possible for the supervision of instant credit providers. As part of the effort to contain household indebtedness, the FIN-FSA has also participated in the positive credit register project led by the Ministry of Justice. The purpose of the positive credit register is to facilitate a view of total indebtedness at the individual level that is as accurate, comprehensive and practicable as possible for situations where credit is granted and sought. A working group lead by the Ministry of the Employment and the Economy is preparing a potential shift of supervision of Finnvera to the FIN-FSA. The shift would take place at the earliest in the turn of 2021–2022. The FIN-FSA’s expertise and resourcing requirements are being planned to ensure its preparedness to embrace the supervisory responsibility.

Insurance sector

The FIN-FSA analysed the solvency and liquidity position as well as the operational capability of supervised entities in the insurance sector – employee pension companies, non-life insurance companies, life insurance companies and unemployment funds – on an enhanced basis through increased reporting frequency. Due to the growth in the number of applications for earnings-related daily allowances, weekly monitoring of processing times and other relevant information was adopted in spring 2020 in the supervision of funds assessed as facing the highest risks concerning operational capability.

Participation in EIOPA’s6 work was more active than previously due to pandemic-related issues. The FIN-FSA reported to the EIOPA on the condition of the Finnish insurance markets. The supervisor participated in the EIOPA in the preparation of regulation and resultant interpretations aimed at responding to the escalating exceptional situation and mitigating its impacts. Towards the end of the year, tighter monitoring of supervised entities and related supervisory actions continued.

On-site inspections halted at the beginning of the year continued on a virtual basis, but no new inspections were launched. The thematic review of compliance was completed.

The number of applications concerning reorganisations of insurance companies and funds increased during the year. Insurance company groups have reorganised and clarified their ownership structures. The FIN-FSA granted authorisation to two new non-life insurance companies, Ålands Försäkringar Ab and the Finnish Mutual Patient Insurance Company. In addition, a significant non-life insurance group operating in Great Britain and Gibraltar was acquired into Finnish majority ownership. In December, the FIN-FSA appointed an authorised representative to supervise the activities of Elo Mutual Pension Insurance Company.

During the year, the FIN-FSA published over 30 supervision releases concerning, for example, solvency position and the monitoring thereof (ORSA7), profit distribution recommendations, outsourcing allowed in the insurance industry, distribution of insurance policies as well as general supervision findings.

Legislative initiatives made by the FIN-FSA in previous years concerning expertise requirements in the employee pension sector and sanctioning possibilities in the insurance industry were advanced in conjunction with initiatives related to the exceptional situation. Their significance in supporting the implementation of supervision is underlined in the situation created by the coronavirus pandemic.

Macroprudential supervision

In March, the FIN-FSA Board decided to ease the structural macroprudential buffer requirements for banks by one percentage point by removing the systemic risk buffer and lowering the O-SII8 requirement for OP Financial Group. In addition, at the end of June, the Board restored the housing loan cap to its baseline level at 90% excluding first-home buyers.

Decisions of the FIN-FSA Board on structural macroprudential buffers as well as other countries’ macroprudential supervisors’ decisions were expected to increase the lending capacity of Finnish banks to Finnish companies and households by approximately EUR 30 billion. Structural macroprudential buffers have been established primarily for severe problems of the banking sector in crisis situations.

Restoration of the maximum loan-to-collateral ratio supported the functioning of the housing markets and the economy in the acute crisis. Due to the exceptional uncertainty caused by high household indebtedness and the pandemic, the FIN-FSA Board emphasised the need for careful assessment of borrowers’ repayment capacity.

The FIN-FSA also made preparations for the implementation of provisions on macroprudential instruments, based on the new Credit Requirements Directive. This so-called banking package was intended to enter into force in early 2021. The FIN-FSA participated in the positive credit register project lead by the Ministry of Finance. The purpose of the positive credit register is to enable a view of total indebtedness at the individual level that is as accurate, comprehensive and practicable as possible for situations where credit is granted and sought. According to the latest estimates, the positive credit register would be in place in spring 2024.

Securities sector

The FIN-FSA intensified cooperation and exchange of information with ESMA9 and national authorities due to the coronavirus pandemic and the market volatility caused by it. During the year, the supervisor also participated in solving Brexit-related interpretation questions. For example, these questions were concerned with the continuation of the provision of service. In particular, questions related to mutual recognition and memoranda of understanding were mainly solved by the end of the year.

Due to the sharp and rapid market movements caused by the pandemic, the FIN-FSA refocused its market supervision activities. The supervisor intensified the supervision of the operation of significant market infrastructures, the stock exchange and central securities depository and monitored the disclosures and financial reporting by listed companies on the impacts of the coronavirus. Companies’ need for finance was reflected, for example, in a growth in the number of subscription rights offerings; prospectus inspection focused particularly on information on the impacts of the coronavirus. The FIN-FSA assessed the need to restrict short selling, and therefore price fluctuations and short positions in financial instruments were monitored and analysed on an enhanced basis in the first half of the year. In addition, the supervisor monitored more closely investment funds’ liquidity management, use of liquidity instruments and valuation. The use of liquidity management instruments by Finnish open-ended UCITS and alternative investment funds was also reported on a weekly basis until the end of the year to ESMA.

The supervisor completed two thematic reviews concerning the provision of investment services: product governance procedure for investment services and products, and the assessment of appropriateness. In addition, the findings of the ESMA-driven pan-European thematic review on investment funds’ liquidity management were completed within schedule. Due to market disruptions affecting the fund sector, the FIN-FSA also conducted another ESMA-driven supervisory initiative, based on the ESRB’s recommendation, on the liquidity management and valuation of open-ended fixed income and real estate funds. A review of algorithmic trading was also completed towards the end of the year. The FIN-FSA published the findings of a thematic review on disclosure obligation in investment-based crowdfunding at the beginning of January 2021. The thematic review of IFRS10 supervision was overhauled in terms of content and focus due to coronavirus so as to include, in particular, companies with a weak financial standing as objects of supervision.

Supervision of digitalisation development

The FIN-FSA is mapping the level of the utilisation of digitalisation and risk management related to digitalisation through a survey. Due to reprioritisation related to the coronavirus pandemic, this survey was postponed to the first half of 2021.

Preparation for disruptions

In the preparation for disruptions project, the goal of the review year was to map the present situation to establish a basis for updating guidance and operating models in 2021–2022. Due to the coronavirus pandemic, however, the updating of the preparation plans for disruptions began during the review year.

Guidance on bank resolution was updated and revised to accord with the economic crisis resulting from the coronavirus pandemic. Operating guidelines for supervised entities in the insurance sector were updated based on regulation for any severe solvency, liquidity or operational capability problems. The securities sector prepared for disruptions affecting the operations of supervised entities by updating internal operating guidelines for interruptions of operations. The supervisor has the preparedness to resolve problem situations affecting authorised payment institutions and to use macroprudential instruments, if necessary.

Climate change and supervision

The project proceeded almost on schedule, and the key objectives set for it were achieved despite changes of priorities related to the coronavirus pandemic.

The ESAs continued the preparation of international legislation for the financial services sector throughout the year. A clear need emerged in the sector for pan-European interpretation of regulation. The FIN-FSA contributed to EU regulation of listed companies’ non-financial information and the development of supervision thereof through ESMA, and it presented the regulation and related changes in several webinars to supervised entities and other stakeholders.

Work on including risks related to climate change in various supervision frameworks as well as the launch of supervision of non-financial information continues in 2021. A series of blogs was published on climate change and sustainable finance.

AML Supervision

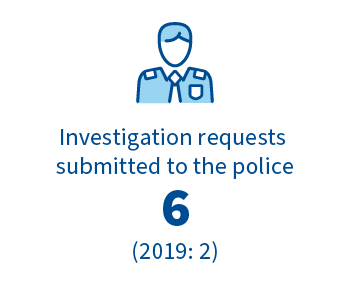

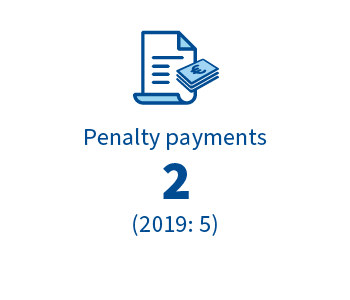

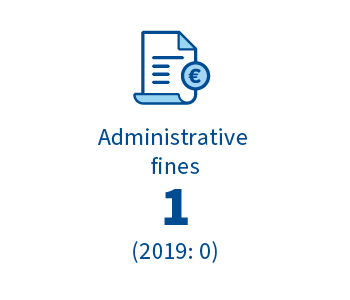

The supervision of anti-money laundering was organised as a dedicated division in 2019, and it was promoted as one of the FIN-FSA’s strategic focus areas in 2020. AML supervision proceeded mainly as planned, although the target state has not yet been achieved.

In 2020, the FIN-FSA prepared a risk assessment which classifies sectors by risk rating. The supervisor published sector-specific risk assessments concerning payment service providers and the life insurance sector.

Due to the coronavirus situation, on-site inspections were put on hold. The inspections continued as applicable through teleworking solutions enabled by digitalisation.

Ongoing supervision meetings with the Nordic and Baltic supervisory authorities continued on a regular basis. The first memoranda of understanding on the principles and responsibilities of practical supervision of supranational credit institutions were signed during the year.

The AML division developed its inspection activities by reorganising the AML inspection team. Towards the end of 2020, the EBA and the Council of Europe completed their assessments of the state of anti-money laundering in Finland. In its assessment, the EBA focused on the FIN-FSA’s activities in the supervision of anti-money laundering and provided recommendations on, for example, how to add depth to the risk-based approach and to develop guidance for supervised entities as well as the FIN-FSA’s internal, national and international cooperation and processes. The European Council assessed the implementation of the 4th Anti-Money Directive as a whole in Finland. The report was not yet finalised by the date of this annual report.

1 ECB = European Central Bank.

2 EBA = European Banking Authority.

3 LSI = Less Significant Institution, bank subject to indirect ECB supervision.

4 JST = Joint Supervisory Team.

5 SI = Significant Institution, bank subject to direct ECB supervision.

6 EIOPA = European Insurance and Occupational Pensions Authority.

7 ORSA = Own Risk and Solvency Assessment.

8 O-SII = Other Systemically Important Institutions.

9 ESMA = European Securities and Markets Authority.

10 IFRS = International Financial Reporting Standards.