Values and strategy

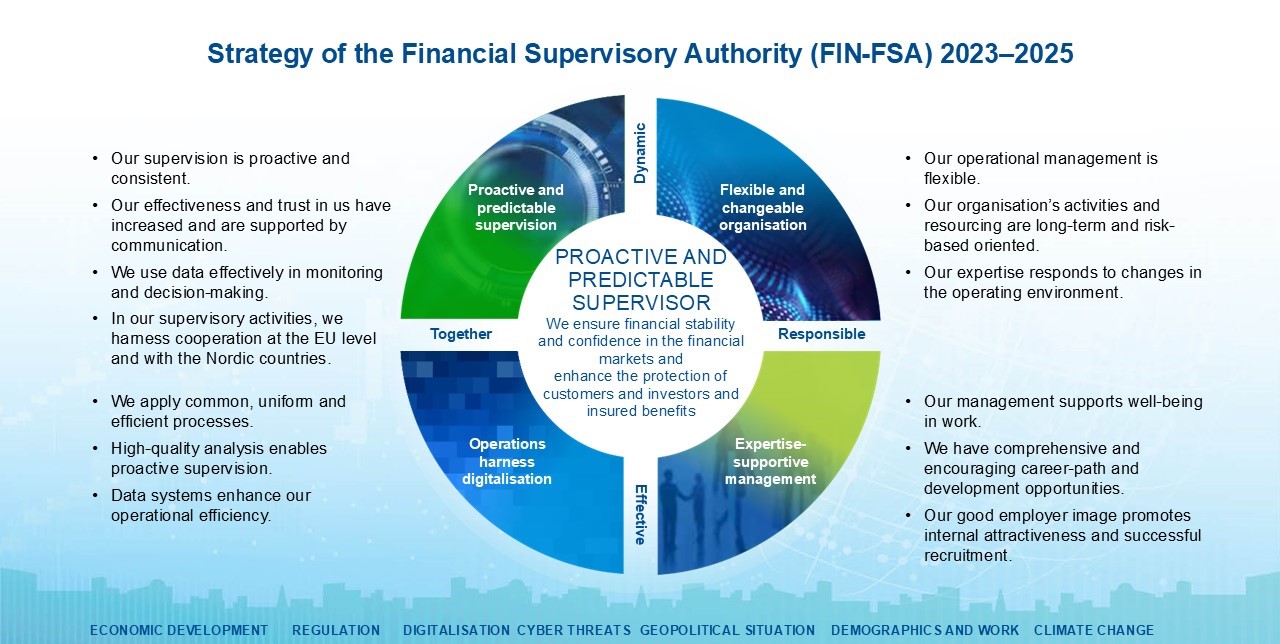

Strategy of the Financial Supervisory Authority (FIN-FSA) 2023–2025

Strategy of the Financial Supervisory Authority (FIN-FSA) 2023–2025 (pdf)

Values

- DYNAMIC

We are pro-active in perceiving changes in our operating environment and supervised entities and continuously develop our activities accordingly. We follow developments in real time and are actively involved in progress at the international level. - RESPONSIBLE

Our activities are consistent, constructive and of the highest quality. We are aware of the consequences of our actions. We communicate openly, bearing in mind our responsibilities. - EFFECTIVE

We concentrate on essentials. We take responsibility for our own and the whole organisation's results. We are vigilant and take swift action when needed. - TOGETHER

We are a supportive working community. We learn constantly and support others in their own professional development. We create a positive team spirit. We work in good cooperation with all our stakeholders.