10. Companies’ processes and controls being developed – demand for new systems

The FIN-FSA asked audit committees to describe whether the company has identified and/or reviewed the impacts necessitated by the implementation of sustainability reporting on its processes, controls and systems (question 5). They were also asked to describe these impacts on reporting, if any.

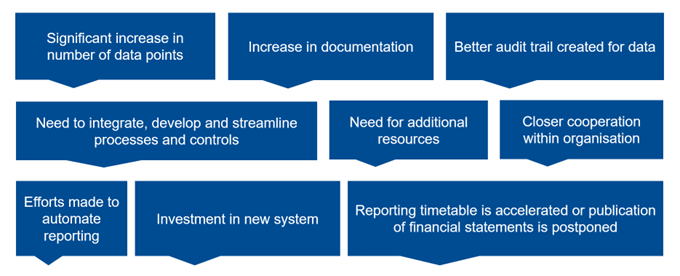

Figure 10. Examples of responses to question 5

According to the responses, in more than half of the companies, the analysis of the final effects on processes, controls or systems is incomplete. In many companies, the impacts of reporting have not yet been assessed, as this is planned to be done, for example, only after the final standards have been confirmed. Despite this, audit committees understand the increase in workload that will follow from reporting. As an example, it was mentioned that “due to the new reporting requirements, there is a need to define new metrics”. Some of the respondents stated that the impacts can only be evaluated after the completion of the materiality assessment and/or gap analysis. As the double materiality assessment plays a very central role in sustainability reporting, one respondent said they were waiting for further guidance from EFRAG.

Many respondents emphasised that sustainability reporting will require significant new data. New data will also be required for companies that already currently report sustainability information using GRI or other frameworks. Collecting new data will require both new processes and more effective controls. The responses stated, for example, that “a significant proportion of the data is located elsewhere than in the current financial management reporting systems” and “for several of the new required data points, deficiencies have been identified in source systems, data availability, manual data collection work, decentralised systems and underdevelopment of controls”.

Around one third of respondents raised the issue of data documentation requirements. One response stated, among other things, that “the new regulations increase documentation requirements for how the results and findings of sustainability reporting have been achieved (operating policies, their controls and measurement)”. Surprisingly few responses drew attention to the integrity and reliability of the audit trail.

Many respondents stated they were either considering investing in new tools or had already decided on investments. One respondent stated that “currently, many sustainability reporting issues are handled manually using separate documents”. According to the responses, a number of potential system suppliers have been evaluated. One respondent “will select a reporting system in late 2023”, while one respondent stated, “systems development will be a multi-year project”.

The timelines for sustainability reporting and financial reporting need to be coordinated. Planning the reporting schedule is seen as the key challenge, and it was stated that “it is not yet possible to assess whether the assurance of sustainability information alongside the financial statements will result in changes to the publication schedule of financial and sustainability reports”. The respondent therefore stated that the company “is considering a test assurance based on 2023 sustainability information”.

According to the understanding obtained by the FIN-FSA, the companies’ processes, controls and systems are being developed, but the work is becoming urgent. Collecting reliable data and making system changes can be very time-consuming and systems may not be available. A verified audit trail is also a key prerequisite for data reliability.