13. Attention paid to assurance of sustainability information

Voluntary assurance

It is currently the task of the statutory auditor to check that a statement of non-financial information in accordance with the Accounting Act has been provided. In addition, the auditor gives an opinion on whether the applicable provisions have been complied with in the preparation of the management report. If the statement of non-financial information is provided as a separate report, the auditor shall state if the information included in the financial statements and the information in the separate report are not consistent. However, assurance of sustainability information or part thereof takes place on a voluntary basis by means of a separate assurance engagement.

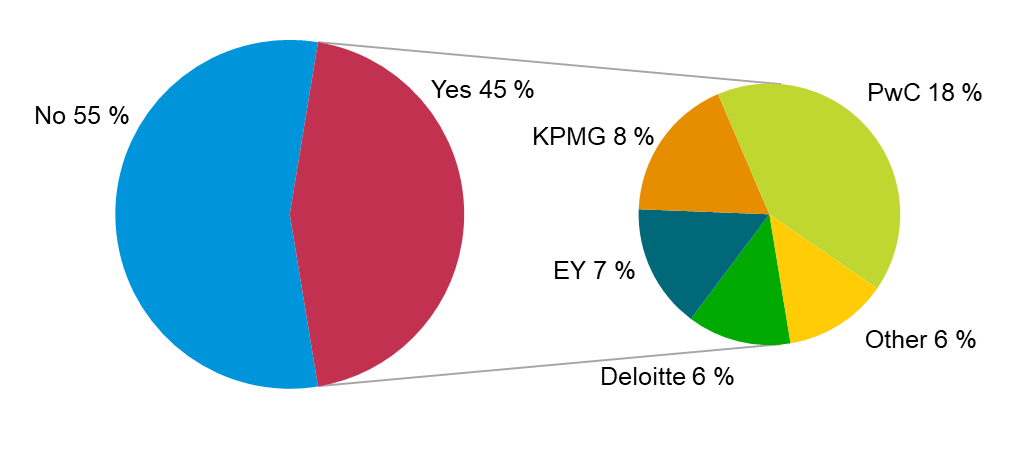

The FIN-FSA asked the companies to state whether the company’s sustainability information had been assured by an independent assurance provider. Companies were also asked to name the assurance provider. Sustainability information or part thereof has been assured in nearly half of the companies. The four largest audit firms have mainly acted as assurance providers. Around 60% of the companies use the same audit firm for the voluntary assurance of sustainability information as for the statutory audit.

Figure 13. Voluntary assurance of sustainability information or part thereof (N=87)

Source: Financial Supervisory Authority.

Statutory assurance

The main implications of the government proposal state that the largest audit firms offer assurance of sustainability reporting to their existing audit clients, and thus it is expected that the demand for sustainability experts will increase strongly within these audit firms.[1] According to the CSRD, statutory auditors or audit firms that carry out the assurance of sustainability reporting should have a high level of technical and specialised expertise in the field of sustainability.

The FIN-FSA asked audit committees what plans they have regarding the assurance of sustainability reporting (question 8). In addition, the audit committees were asked how the audit committee will, for example, assess the assurance provider’s substance and assurance expertise.

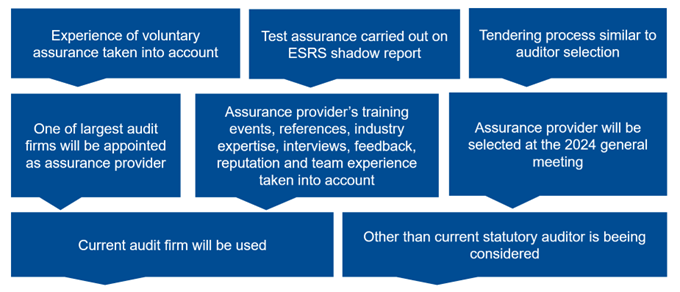

Figure 14. Examples of responses to question 8

A number of the respondents emphasised the company’s experience of voluntary assurance gained over the years. Sustainability information has been reported, for example, in accordance with the GRI for many years, and it was stated “the scope of sustainability information subject to assurance has increased over the years”.

Not all of the respondents have experience of voluntary assurance, but the process of selecting an assurance provider is considered to be very similar to that of selecting a statutory auditor. One respondent stated, for example, that “the tender for the assurance provider will take place in H2/2023 and the audit committee will be responsible for the tendering process. The assurance provider will be selected at the 2024 annual general meeting on the proposal of the board of directors, based on the recommendation of the audit committee. The eligibility requirements and independence requirements required by law, as well as other competence requirements required by the committee, will be evaluated in the tendering process”.

Around one third of the audit committees stated that their company plans to use the current statutory auditor as the sustainability reporting assurance provider, but other audit firms are also being considered:

- “The audit committee is considering using the audit firm for sustainability reporting assurance, but will make the final selection based on substance and assurance expertise.”

- “The assurance provider will be subject to competitive tender, and the decision will be guided not only by commercial aspects, but also by substance expertise and knowledge of the field.”

Some of the respondents said that they have taken into account or will take into account sustainability reporting assurance in connection with tendering for a statutory auditor. One respondent stated that “in connection with the audit tender for 2023, offers for sustainability reporting assurance and information on the expertise of the tenderers have also been requested from audit firms”.

The audit committees have confidence in the biggest audit firms. For example, one respondent stated that “for the assurance of sustainability reporting, the intention is to use a Big4 firm to ensure the substance and assurance expertise of the assurer”. The biggest audit firms are considered to have “very comprehensive services and competent experts in the ESG field” and “we expect them to provide us with adequate internal resources”.

Few respondents are concerned that audit firms would not have enough ESG experts. According to one respondent, the FIN-FSA “should also focus attention on the ability of assurance providers and audit firms to perform the upcoming assurance work. This will be important, as the number of companies subject to mandatory sustainability assurance is increasing and the time window for assurance is very short, and particularly as all listed companies are facing the same challenges at the same time”.

The responses mentioned the evaluation of the assurance provider’s substance and assurance expertise. The evaluation is considered to be very similar to the evaluation of a statutory auditor’s substance expertise. The responses mentioned, among other things, “training given by the assurance provider”, “knowledge of the field”, “references from global listed companies” and “the assurance team’s work experience of similar assurance engagements”. One respondent stated that the audit committee “also regularly receives feedback from the management on the performance and cooperation with the Big4 audit firm.”

According to the FIN-FSA’s understanding, audit committees have a key role in selecting the sustainability reporting assurance provider, in monitoring and assessing the assurance, and in dialogue. In addition to the high level of expertise of the sustainability reporting assurance provider, the FIN-FSA considers it important that sufficient time and resources are allocated to the execution of assurance. Close dialogue with the assurance provider initiated at an early stage (for example, regarding the determination of materiality) as well as good documentation by the company, will promote the quality of the assurance. Previous experience of voluntary assurance does not remove all challenges.

1 Government proposal 20/2023 vp, p. 20 (Proposals and their implications) (in Finnish).