15. Audit committees have identified a number of challenges in preparing for sustainability reporting

Finally, the audit committees were asked whether there any other matters with relevance to the implementation of sustainability reporting that they wished to communicate to the FIN-FSA (question 10).

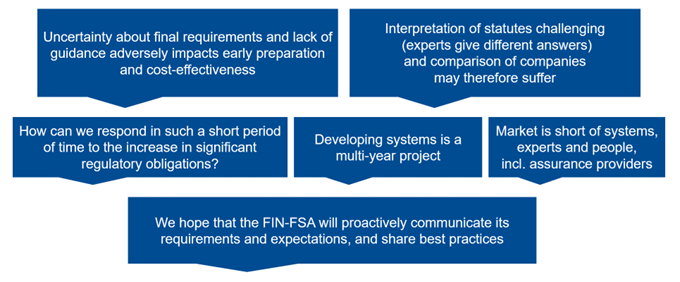

Figure 15. Examples of responses to question 10

In responses to the final question, most of the respondents highlighted concerns and observations. Around half of respondents saw the timeline as a challenge in preparing for sustainability reporting:

- “The late finalisation of the CSRD and ESRS means that the timeline for implementation is incredibly short.”

- “In general, changing reporting requirements and the tight schedule will present companies with significant challenges.”

- “The timetable is really challenging as the reporting obligation starts on 1 January 2024 and the content of the standards is not yet confirmed. As regards the value chain, incompleteness of data is to be expected, particularly for smaller companies in such a short transition period.”

- “From the company’s standpoint, the timetable for the implementation of more comprehensive sustainability reporting is fast, which means that the company faces challenges in getting all the processes required by reporting to work effectively within the timeframe demanded by the new reporting requirements.”

The number of regulations and their incompleteness and interpretation attracted comment in around one quarter of the responses:

- “The sustainability reporting regulations introduce a large number of new reportable parameters for sustainability.”

- “The main challenge has been the fact that the requirements have gone through a lot of changes in the past years, and this has made the preparations more difficult.”

- “Uncertainty about the final requirements and the amount of discretion involved adversely affects preparation and also significantly increases costs to the organisation.”

- “In the absence of previous examples and guidance, companies will have to do a lot of their own interpretation of the texts of the regulations and standards.”

Workload as well as adequacy of resources and expertise were considered to be a challenge in a number of responses:

- “Challenges include a significantly increased workload related to reporting and the future scope of reporting.”

- “The CSRD brings with it many new resource and expertise requirements. Developing these is an ongoing process and will take time.”

- “The new sustainability reporting requirements demand from companies new expertise, and with the current resources it is challenging to react to the changes with sufficient diligence within the timeframe set by the legislation.”

A few respondents drew attention to the assessment of materiality:

- “One challenge is the subjectivity related to the materiality assessment process and the uncertainty about how the audit firm will assess which topics are material in the company’s business.”

- “The reporting requirements are based more widely than originally planned on companies’ (ultimately always subjective) double materiality assessments, and not on the mandatory reporting requirements for all, so this may adversely affect comparability of information.”

Wishes were also expressed for the work of the FIN-FSA:

- “We hope that the FIN-FSA will proactively communicate its requirements, expectations and approaches in the future.”

- “The company hopes that the FIN-FSA would give companies sufficient time to develop reporting before strict implementation of the requirements.”

- “The FIN-FSA could, while collecting feedback like this, help to interpret the still evolving standards to alleviate the additional resource pressures as well as help by actively sharing Finnish enterprises’ feedback with EU-level bodies, too.”

- “We value all available training for audit committees (such as the FIN-FSA’s listed company events, the FIN-FSA’s market newsletters, etc.), as well as sharing of best practices with companies.”

The FIN-FSA considers the concerns raised to be justified and shares the views of the audit committees. The views of market participants have an impact on the enforcer’s work. ESMA also consults market participants twice a year in its Consultative Working Group, in which there is skilled Finnish representation. The FIN-FSA provides information on ESMA’s activities and disseminates ESMA reports through its various communication channels. The FIN-FSA supports market participants through ESMA’s activities.

Harmonised enforcement is being prepared in Europe. ESMA is issuing guidelines to national competent authorities on the enforcement of sustainability information. The guidelines are based on guidelines on enforcement of financial information1, so the enforcement of sustainability information will generally be similar to the already established IFRS enforcement for listed companies. ESMA will publish a public consultation on its guidelines in early 2024.

Enforcement of sustainability reporting is currently being launched by the FIN-FSA. The launch will involve, among other things, situation mapping, such as the audit committee survey. No decisions have yet been taken on the practical arrangements for enforcement and it will be established over the coming years. The enforcement of listed and unlisted banks’ and insurance companies’ sustainability reporting is carried out by FIN-FSA’s Banking and Insurance Supervision departments.

For further information, please contact:

- Tiina Visakorpi, Head of Division, tiina.visakorpi(at)finanssivalvonta.fi

- Laura Heinola, Senior Expert, laura.heinola(at)finanssivalvonta.fi