7. Sustainability matters on audit committees’ agenda

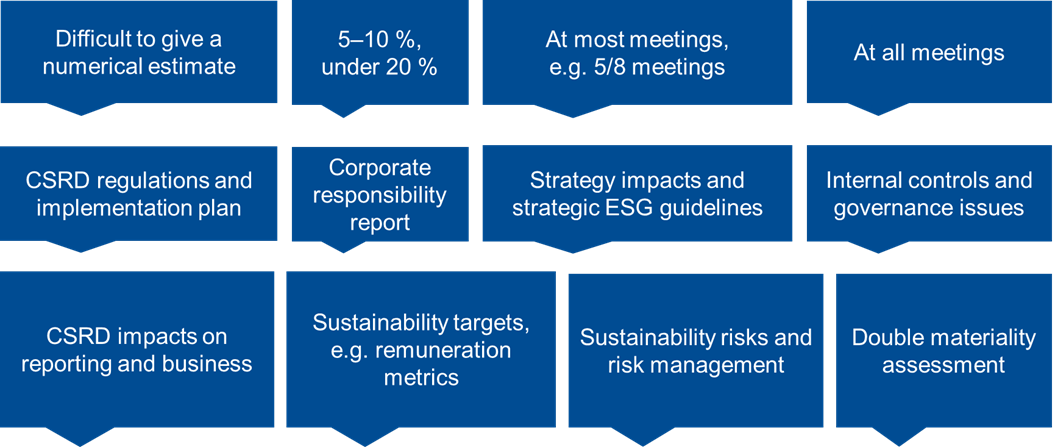

The FIN-FSA asked audit committees to estimate how much of their time in the past year was spent on sustainability matters relative to other audit committee matters (e.g. 20%), and which topics required the most attention (question 2).

Figure 7. Examples of responses to question 2

Almost all of the audit committees have addressed matters related to sustainability. Often, sustainability matters are closely integrated with other topics addressed by audit committees, making it difficult for respondents to precisely estimate the time spent by audit committees on sustainability matters.

Audit committees have dealt with a number of different topics, depending on how far the companies’ implementation projects have advanced. Most frequently mentioned in the responses were familiarisation with CSRD requirements and implementation of the regulations, as well as preparing the corporate responsibility report according to current regulations. One respondent stated that “as far as the audit committee is concerned, the focus of sustainability-related tasks has been on the company’s mandatory corporate responsibility reporting, processing regulatory changes regarding sustainability reporting, and sustainability matters as far as they are related to the company’s risk management, internal control and internal audit activities”.

A number of audit committees have reached a stage in the implementation of the regulations where they are assessing the various concrete impacts on reporting and business activities, as well as on business and ESG strategies. This was highlighted, for example, as follows: “The importance of sustainability matters in the future, changes in the business environment, and reporting obligations are discussed at every board meeting. Sustainability is one of the key areas of the strategy.”

Many respondents highlighted the impacts on the company’s internal control systems and/or risk management. One respondent summarises the audit committee’s discussion topics as follows: “The key topics discussed included preparations for the relevant scope of the sustainability reporting in the annual report, data sourcing, and data quality and the control environment”.

An example of one response: “The company recognises that the CSRD will fundamentally change the requirements for sustainability reporting and will raise them to the same level as for financial reporting, including a limited assurance audit. For this reason, in early 2023, the company launched a CSRD implementation project, which included an in-depth gap analysis where the company’s current approach was compared with the CSRD requirements, to ensure that the company will fulfil the CSRD requirements in 2025. In addition, a double materiality assessment, required by the CSRD, was started in the spring. The Chief Financial Officer and the Sustainability Director are responsible for preparing the implementation of sustainability reporting. The Board, the Audit Committee and the Executive Committee are closely monitoring the progress of the CSRD implementation project, and the status of the project will be discussed at each Audit Committee meeting in late 2023. The company recognises that the national implementation of the directive is still pending and it will continue to monitor this and the implementation of the final requirements, as part of the CSRD implementation project.”

According to the understanding obtained by the FIN-FSA, sustainability matters are strongly on the agenda of audit committees. The FIN-FSA considers this important, as the audit committee has a key role in preparing for sustainability reporting.